Create your account

Prequalify before you buy. Get your Affirm purchasing power before or while you’re out shopping. Applying will not impact your credit score.

What is Affirm?

Affirm is one of Canada’s leading installment payment platforms, providing shoppers with payment solutions at their favourite retailers, both in-store and online.

How to buy with Affirm

STEP 1

Fill your cart

Shop at many of your favourite stores and select Affirm at checkout. Then enter a few details for an instant decision. We do a soft credit check when you apply for any Affirm payment plan. This won’t impact your credit score.

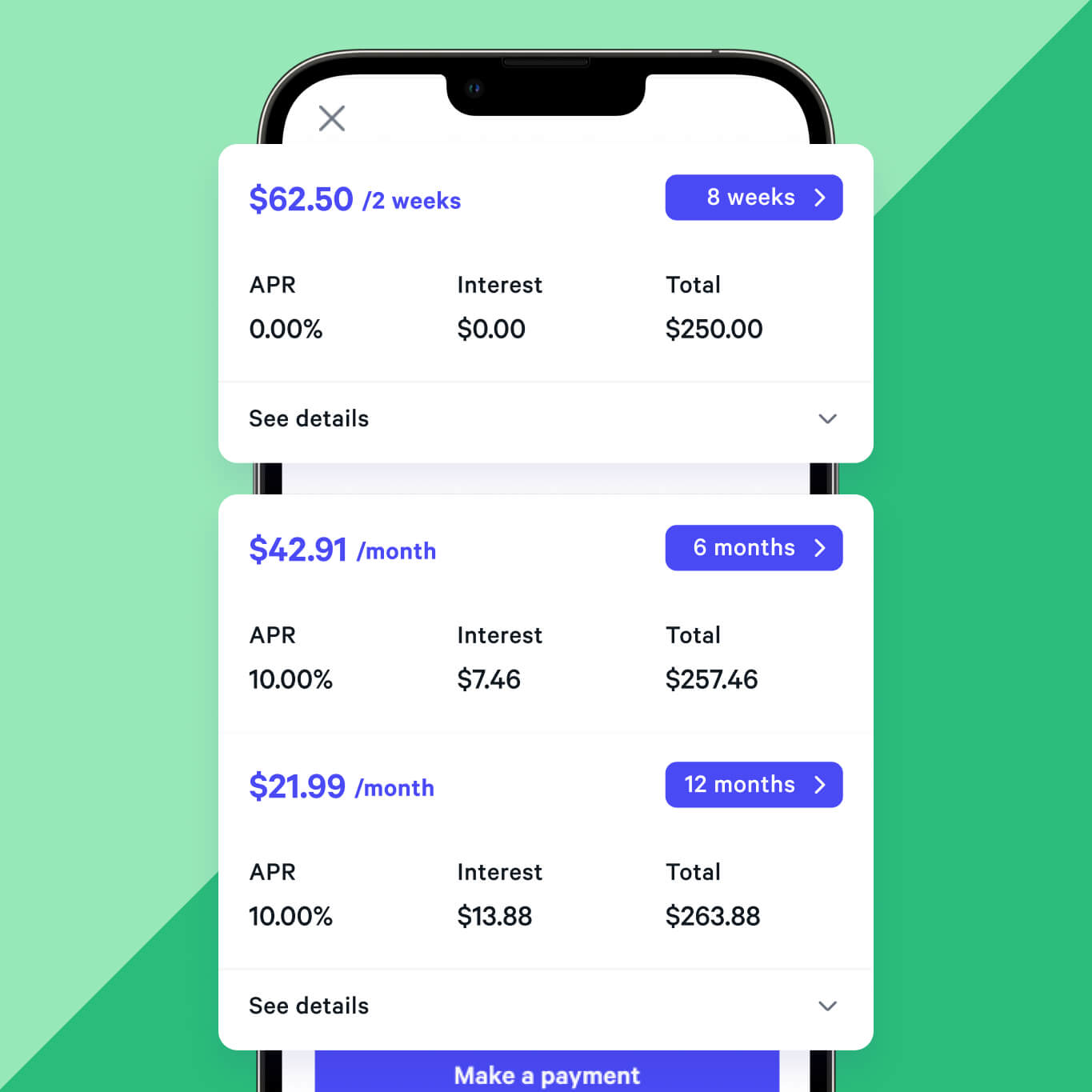

Choose how to pay

Select your payment plan, then confirm your loan. We’ll never charge more than you see up front.

For example: Let’s say you make a purchase of $1,000. Choose to make 4 biweekly, interest-free payments of $250 or pay over 3 ($333/mo), 6 ($166/mo) or 12 ($83/mo) months from 0-32% APR (subject to provincial regulatory limitations). Please see table for more details.

STEP 3

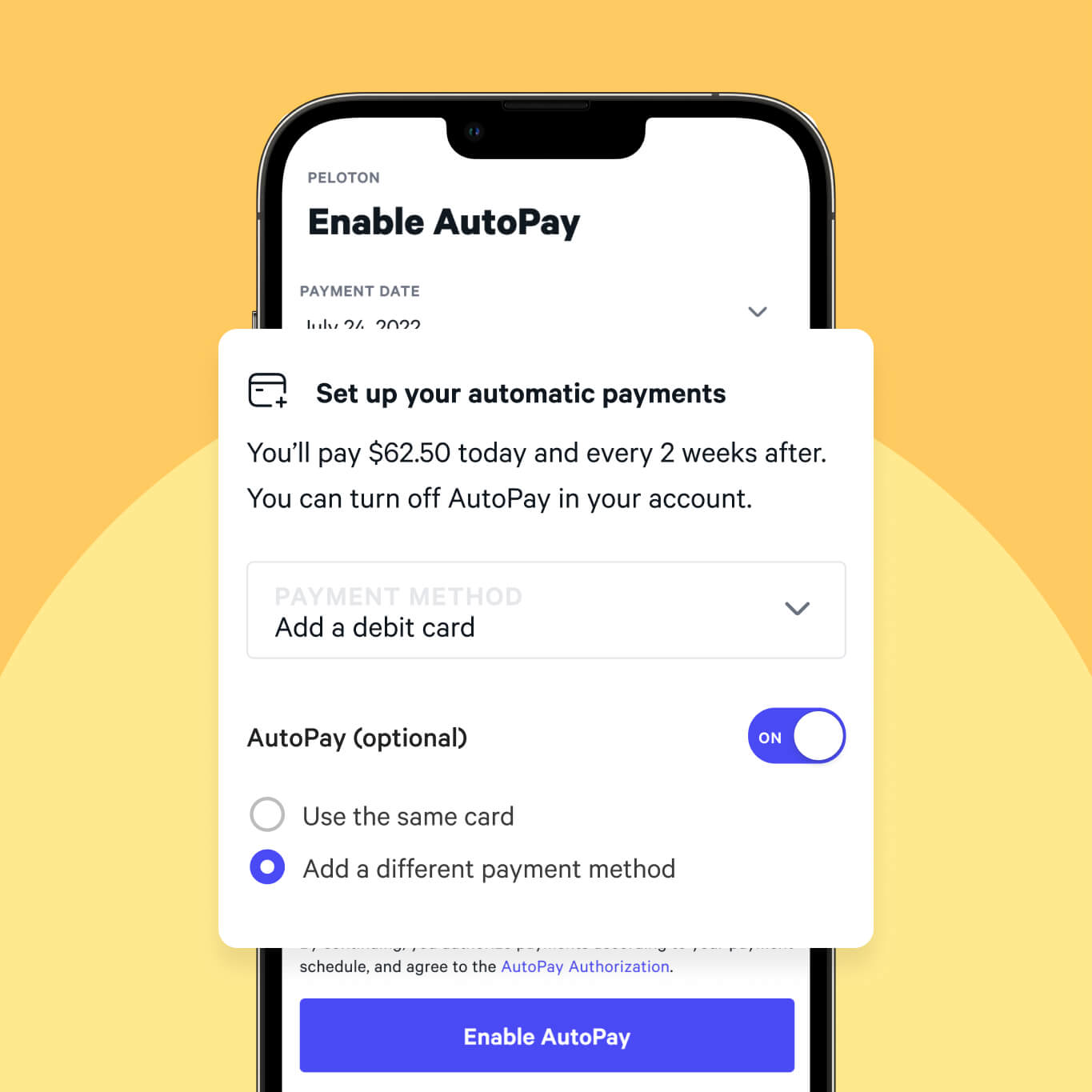

Make your payments

Manage your payments in the Affirm app or online, and set up AutoPay so you don’t miss a payment. But if you do, you’ll never pay any fees.

Questions? We’re here to help

Will Affirm affect my credit score?

Creating an Affirm account and seeing if you prequalify will not affect your credit score.

Does Affirm charge interest and fees?

Fees – We don’t charge any fees. That means no late fees, no prepayment fees, no annual fees, and no fees to open or close your account.Interest – Depending on the size of your purchase and where you’re shopping, your payment plan may include interest. You’ll never owe more interest than you agree to on day one—so you always know exactly what you’re getting into.

What does it mean to prequalify?

When you prequalify, you get an estimate of how much you can spend with Affirm. You don’t have to use the full amount, and you’re not on the hook to pay anything back until you make a purchase. The final amount you qualify for is subject to eligibility criteria.

Can I use my PayBright login on Affirm?

PayBright is now Affirm! When you make your first purchase with Affirm, you will create a new account. If you have an existing PayBright loan, you can access your PayBright loan and account information through the PayBright portal.

“Payment option through Affirm Canada Holdings Ltd. (“Affirm”). Your rate will be 0–31.99% APR (where available and subject to provincial regulatory limitations). APR offered is based on creditworthiness and subject to an eligibility check. Not all customers will be eligible for 0% APR. Payment options depend on your purchase amount, may vary by merchant, and may not be available in all provinces/territories. Actual payment option terms will be shown at checkout. A down payment (or a payment due today) may be required. Affirm accepts debit cards and PAD as forms of repayment on payment options. Select payment options may be eligible for repayment in the form of credit cards. Please review the terms and conditions of your credit card when using it as a form of repayment. Sample payment options may be: a $800 purchase could be split into 12 monthly payments of $72.21 at 15% APR, or 4 interest-free payments of $200 every 2 weeks. For more information, please see https://www.affirm.com/en-ca/